RBI Monetary Policy Meeting LIVE: Sensex, Nifty Open Higher as Repo Rate Decision Approaches

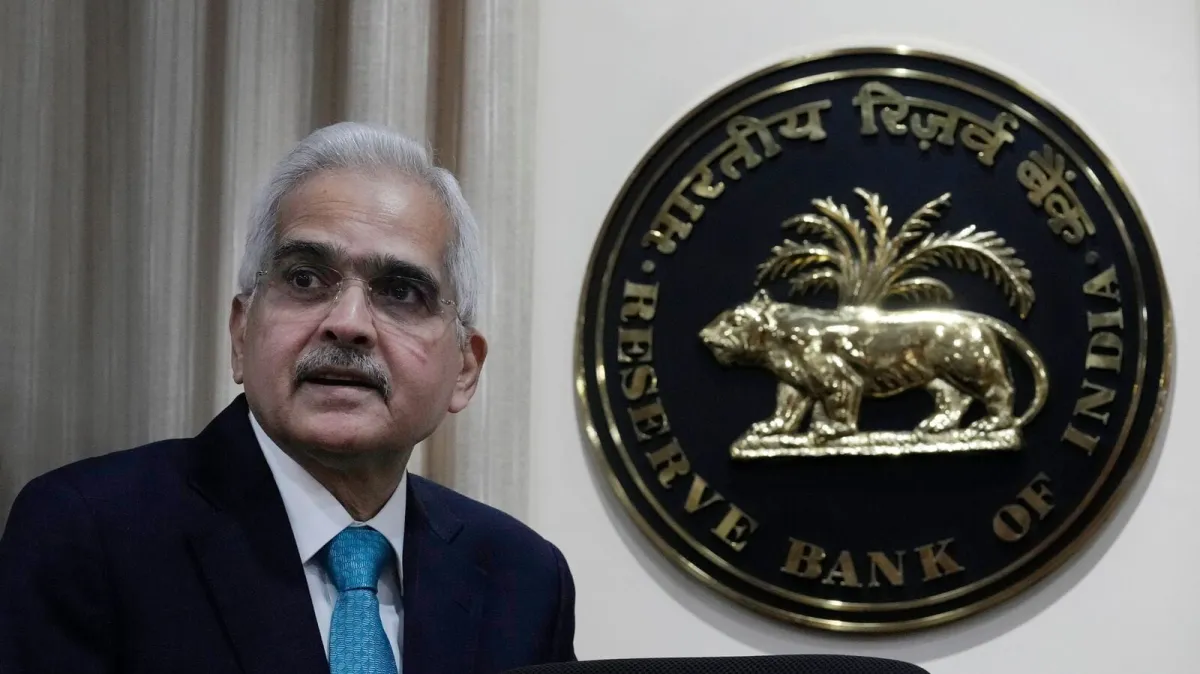

The Reserve Bank of India (RBI) is set to unveil its much-awaited monetary policy today, marking the conclusion of its fourth bi-monthly Monetary Policy Committee (MPC) meeting for FY25. With economists and financial experts closely watching, RBI Governor Shaktikanta Das will announce the key decisions at 10:00 AM.

This meeting holds special significance as the RBI is widely expected to hold the repo rate steady at 6.5% for the tenth consecutive time. The RBI has kept the rate unchanged throughout 2024, aiming to strike a balance between controlling inflation and supporting economic growth. While the repo rate itself may remain unchanged, many experts anticipate a potential shift in the RBI’s policy stance from “withdrawal of accommodation” to a more neutral outlook, signaling possible rate cuts shortly.

Key Developments Leading to the Announcement

Indian markets opened positively in anticipation of the RBI’s policy. The Sensex surged 319.77 points, or 0.39%, to open at 81,954.58, while the Nifty 50 climbed 52.65 points, or 0.21%, to begin at 25,065.80. These gains reflect market optimism that the RBI's policy could provide further clarity on its approach toward inflation and interest rate management.

Prashant Pimple, Chief Investment Officer at Baroda BNP Paribas Mutual Fund, commented on the expectations: “The RBI is likely to adopt a supportive stance toward banks, focusing on measures to help mobilize deposits. Given the evolving global and domestic interest rate scenarios, we expect the central bank to maintain a steady approach while also creating room for flexibility in future rate cuts.”

Another key expectation is that the RBI may stress an “actively disinflationary” stance, preparing the ground for a potential easing cycle later in the year. Madhavi Arora, Lead Economist at Emkay Global, highlighted that while no immediate rate action is expected, a change in stance would likely set the stage for a shallow easing cycle, possibly starting as early as December 2024.

Inflation and GDP Growth Projections

The RBI has been closely monitoring inflation trends, particularly food prices, which have shown fluctuations in recent months. Despite this, India’s CPI inflation has remained within the RBI’s target range for two consecutive months, registering at 3.65% in August. In its August policy meeting, the RBI maintained its FY25 inflation forecast at 4.5%, while also slightly adjusting quarterly projections. Notably, the Q2 FY25 inflation forecast was raised from 3.8% to 4.4%, reflecting ongoing concerns about food price volatility.

On the growth front, the RBI is expected to maintain its GDP growth projection at 7.2% for FY25, reaffirming its confidence in India’s economic resilience. Despite some signs of softening in economic momentum, the central bank continues to project strong growth, particularly as private consumption and investment pick up pace.

Market Sentiment Ahead of the Announcement

Indian markets have been buoyed by the expectation of stability, with investors hoping for more clarity on the RBI’s long-term strategy. The rupee also gained ground ahead of the announcement, appreciating 6 paise to trade at 83.91 per USD in early market sessions.

The upcoming policy meeting is also noteworthy as it is the first after the government’s recent appointment of three new external members to the MPC: Saugata Bhattacharya, Dr. Nagesh Kumar, and Professor Ram Singh. Their perspectives are expected to add fresh insights to the committee's deliberations.

What to Expect

As the financial world waits for the official announcement, all signs point toward a steady repo rate and potentially a neutral policy stance from the RBI. If the central bank does indeed shift its stance, it would signal that the RBI is preparing the market for a possible rate cut in future meetings, depending on how inflation and growth evolve in the coming months.

For now, the RBI’s focus will likely remain on maintaining price stability, supporting banks, and preparing the ground for gradual easing if inflation moderates and global conditions remain favorable.

Reference From: www.livemint.com